In general, the salvage value is important because it will be the carrying value of the asset on a company’s books after depreciation has been fully expensed. It is based on the value a company expects to receive from the sale of the asset at the end of its useful life. In some cases, salvage value may just be a value the company believes it can obtain by selling a depreciated, inoperable asset for parts.

Example of salvage value calculation for a car belonging to a business for after and before tax

The former gives a glimpse into an asset’s future worth, while the latter reflects its present financial standing. Consider the asset’s estimated useful life, representing the expected duration over which the asset will provide value or be in active use. By giving due importance to scrap value, businesses can not only optimize their asset how is salvage value calculated utilization but also maintain precise and strategic financial records. By estimating the value, companies can assess the potential returns they may receive when the asset is retired or sold. Grasping this idea is crucial as residual value aids companies in making educated choices related to asset acquisition, depreciation, and disposal.

Step 3 of 3

The money I get back on my old phone is known as its salvage value, or its worth when I’m done using it. Companies can also use comparable data with existing assets they owned, especially if these assets are normally used during the course of business. For example, consider a delivery company that frequently turns over its delivery trucks. That company may have the best sense of data based on their prior use of trucks. Sometimes, an asset will have no salvage value at the end of its life, but the good news is that it can be depreciated without one. The salvage value of a business asset is the amount of money that the asset can be sold or scrapped for at the end of its useful life.

Determining the Salvage Value of an Asset

This is the most the company can claim as depreciation for tax and sale purposes. One of the first things you should do after purchasing a depreciable asset is to create a depreciation schedule. Through that process, you’re forced to determine the asset’s useful life, salvage value, and depreciation method. Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important component in the calculation of a depreciation schedule. Next, the annual depreciation can be calculated by subtracting the residual value from the PP&E purchase price and dividing that amount by the useful life assumption.

Salvage Value – A Complete Guide for Businesses

The after tax salvage value online calculator provides us the after-tax value of the salvage of the asset. You want your accounting records to reflect the true status of your business’s finances, so don’t wait until tax season to start thinking about depreciation. You might have designed the asset to have no value at the end of its useful life. Perhaps you hyper-customized a machine to the point where nobody would want it once you’re through with it. Even some intangible assets, such as patents, lose all worth once they expire.

- As is clear from the definition, the value of equipment or machinery after its useful life is termed the salvage value.

- Besides, the companies also need to ensure that the goods generated are economical from the customer’s perspective as well.

- This method also calculates depreciation expenses based on the depreciable amount.

- The salvage value is used to determine annual depreciation in the accounting records, and the salvage value is used to calculate depreciation expense on the tax return.

- It assists organizations in making sound financial decisions, managing depreciation, and optimizing resource allocation.

These sources will give you valuable insights into the asset’s estimated value. Consulting with experts or considering alternative valuation methods may be necessary for more complex or specialized assets. Some financial institutions may even have their own sophisticated methods and valuation models that already are in place, which does not require them to follow the two common methods mentioned above.

- Each asset type may have different factors influencing its value, such as market demand, technological advancements, and expected usage patterns.

- The cost of an asset and its expected lifetime are factors that businesses use to find the best way to deduct depreciation expenses against revenues.

- From there, accountants have several options to calculate each year’s depreciation.

- The value depends on how long the company expects to use the asset and how hard the asset is used.

- Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How To Calculate an Asset’s Salvage Value

Let’s say the company assumes each vehicle will have a salvage value of $5,000. This means that of the $250,000 the company paid, the company expects to recover $40,000 at the end of the useful life. Other commonly used names for salvage value are “disposal value,” “residual value,” and “scrap value.” Net salvage value is salvage value minus any removal costs.

Have your business accountant or bookkeeper select a depreciation method that makes the most sense for your allowable yearly deductions and most accurate salvage values. First estimate the asset’s salvage value which is the residual value of an asset at the end of its useful life. Divide the result, which is the depreciation basis, by the number of years of useful life.

While there are risks to buying a salvage title vehicle, there are also some benefits. If you can get the car checked out by a reliable mechanic to confirm it is safe to drive, then a salvage title vehicle could be the right purchase. “Repairing a salvage vehicle can be worth it if the cost of repairs is significantly lower than the vehicle’s post-repair market value,” says John Crist, founder of Prestizia Insurance. In general, salvage vehicles are worth between 20% and 40% less than their Kelley Blue Book value. With that, it’s a good idea to get a salvaged vehicle appraised privately to determine its value accurately.

- It does this because Depreciation is deducted as an expense against the revenue earned by the company.Secondly, Depreciation helps in matching expenses against revenue over the useful life of assets.

- In the case of damaged or totaled assets, the salvage value may be considered in insurance claims to determine the overall loss or value of the asset.

- Through that process, you’re forced to determine the asset’s useful life, salvage value, and depreciation method.

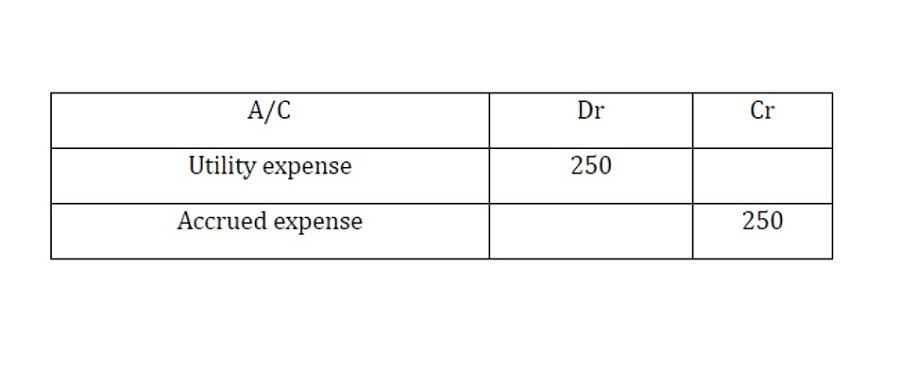

- At the end of the accounting period — either a month, quarter, or year — record a depreciation journal entry.

- Say you own a chocolate business that bought an industrial refrigerator to store all of your sweet treats.

Do you own a business?

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. By the end of the PP&E’s useful life, the ending balance should be equal to our $200k assumption – which our PP&E schedule below confirms. The beginning balance of the PP&E is $1 million in Year 1, which is subsequently reduced by $160k each period until the end of Year 5. We’ll assume the useful life of the car is ten years, at which the car is practically worthless by then, i.e. for the sake of simplicity, we’ll assume the scrap value is zero by the end of its useful life. Briefly, suppose we’re currently attempting to determine the salvage value of a car, which was purchased four years ago for $100,000. In order words, the salvage value is the remaining value of a fixed asset at the end of its useful life.